Want to Make Extra Money Now?

|

Are you a freelancer in the gig economy or one of the currently 44 million self-employed individuals in the United States? It’s best for you to manage your money by using a dedicated business account designed for freelancers and business owners rather than by using your personal checking account.

Of course, it’s not a necessity for you to open a separate bank account for your freelancing business, but it will help you a lot in running and managing your business later.

The good thing about opening an account with banks for freelancers is that these banking services will provide you with the business-specific features you might not get from your traditional bank accounts. Also, by opening a dedicated bank account for your freelancing business, you can separate your personal expenses from your business-related expenses, which can save you a lot of time when you need to do some accounting or tax filing for it.

Best Business Bank Accounts for Freelancers and Self-Employed Workers

There are many business bank accounts designed for freelancers and self-employed workers you can use today.

Most of them offer features that can help freelancers and business owners to manage and run their businesses. Here are 10 recommended bank accounts for freelancers and self-employed workers:

1. Found

Found is a free business banking service designed specifically for self-employed individuals. It offers unique features such as smart tax and bookkeeping to help users manage their finances.

The Found business debit Mastercard is the perfect way to keep tabs on your expenses and save money for taxes. The card automatically categorizes purchases and estimates tax bills in real-time, so you'll always have enough set aside.

Features:

- Found allows you to manage your finances all in one place—for free.

- Easily send invoices, save receipts, run reports, and even pay your taxes right from the app.

- Linking it to your payment apps or other bank accounts makes for effortless money management.

Found's features ease the burden of having to constantly cycle between platforms or pay for other financial tools that end up being ineffective.

All in all, Found provides dependable business banking and top-notch features—without any fees or minimums. In using Found, you're saving both time and money.

Found is a business checking account designed for a small one-person business. Manage all your finances from the Found app, including tracking your income and expenses, sending invoices and automatically setting aside taxes for your quarterly tax payments.

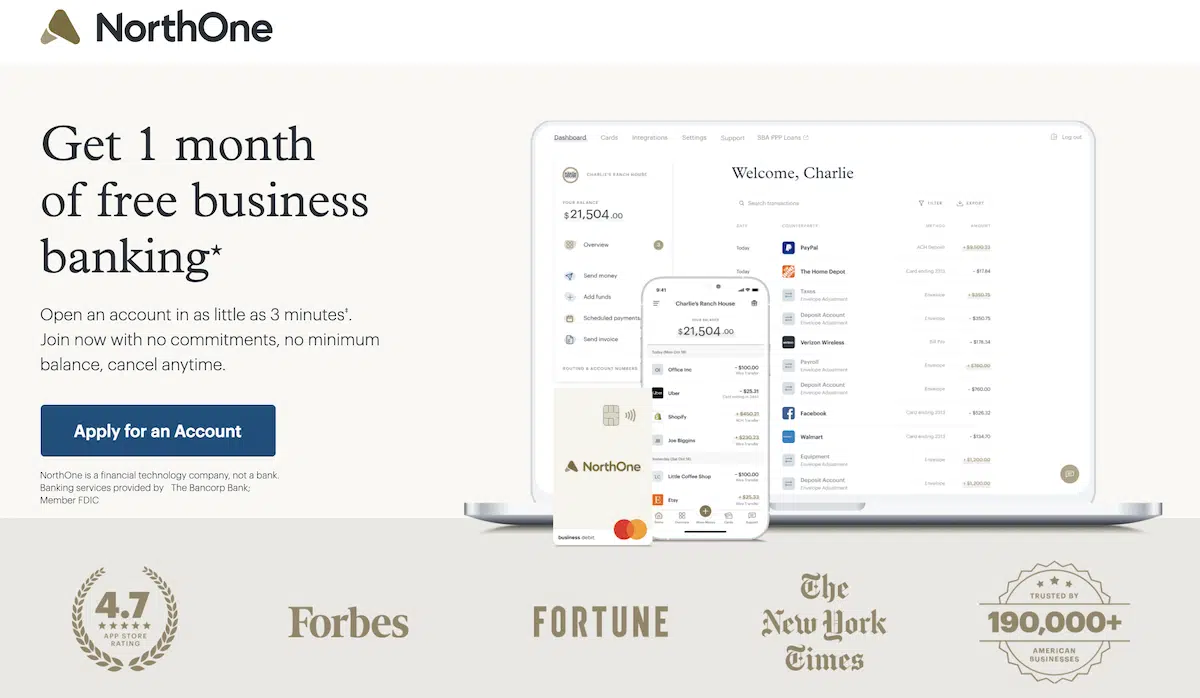

2. NorthOne

NorthOne provides a business banking account for freelancers, self-employed individuals, and business owners. With the low $10 per month fee, you can get access to the digital banking service that provides all the tools you need to save and manage your money. You can also use your bank account for budgeting and planning for your business.

Features:

- NorthOne provides digital banking tools with support for ACH and wire transfers, and also the option for you to deposit checks on the go.

- You will get a debit card for your account and you can make deposits anywhere.

- You can also use NorthOne to budget your money expenses for various purposes, such as taxes, rent, payroll, and more.

★★★★★ 5/5

The NorthOne business bank account is a worthwhile option for any freelancer or small-business owner looking for an online business checking account. For a $10 monthly fee, NorthOne offers unlimited fee-free transactions, fee-free in-network ATM access and a variety of digital tools.

3. Novo

Novo provides a simple and powerful business banking solution with no hidden fees, easy transfers, and online banking system. You can sign up for a free business checking account and get access to various small business tools from your account. It also provides the virtual card that you can use for instant and secure spending from your Novo account.

Features:

- Novo provides a simple banking account for business owners, freelancers, and entrepreneurs, which you can use in the US and abroad.

- It also provides a list of apps you can access to make it easier for you to manage your business with your Novo account, such as Etsy, Quickbooks, Xero, Amazon, WooCommerce, and more.

- You can get the physical debit card from Novo with an EMV chip, along with the virtual card for digital transactions.

With no monthly fees, unlimited refunds for ATM charges and a focus on digital banking, Novo business checking is a great option for small-business owners on the go. But Novo bank cannot accommodate cash deposits, an essential feature for many businesses.

4. Axos Basic Business Banking

Axos Basic Business Banking is the business checking account from Axos designed for business owners with modest checking needs. You don’t need to pay any maintenance fee per month for your account, and there is no minimum balance you need to maintain. With this business checking account, you can send your first 50 checks for free.

Features:

- Axos Basic Business Banking provides the online banking services with various business tools you can use, which are also accessible via your mobile device.

- You can also create low-fee accounts for your employees via Axos Basic Business Banking, which can make it easier for you to send payroll to them.

- It can accept ACH payments, and it is compatible with QuickBooks.

Axos Bank offers two small-business checking accounts — Basic Business Checking and Business Interest Checking — that can be opened and managed completely online. Both of these accounts include unlimited domestic ATM fee reimbursements, free bill pay and mobile check deposit.

5. Lili

Lili Banking provides freelancers with the banking services they need, allowing freelancers and business owners to manage various aspects of their business finances in their account. With Lili, you will get the Visa debit card you can use in any ATM and merchants worldwide, with cashback rewards in participating merchants. Lili provides security and peace of mind for each transaction you make in your account.

Features:

- Lili provides various business tools any freelancers and business owners can use, including expense management, tax bucket, invoices, and Visa business debit card.

- It provides various features that ensure your banking security and peace of mind, including transaction notifications, the option to freeze and unfreeze your card, and FDIC-insured account.

- Lili also provides automatic savings with 1% APY and fee-free overdraft for up to $200.

The Lili bank account has no monthly fees, no minimum opening deposit and is completely mobile — with an app available for iOS and Android devices. Lili is designed specifically for freelancers and independent contractors, offering digital tools that allow you to categorize your business and personal expenses, save for taxes and accept payments from customers within a single account.

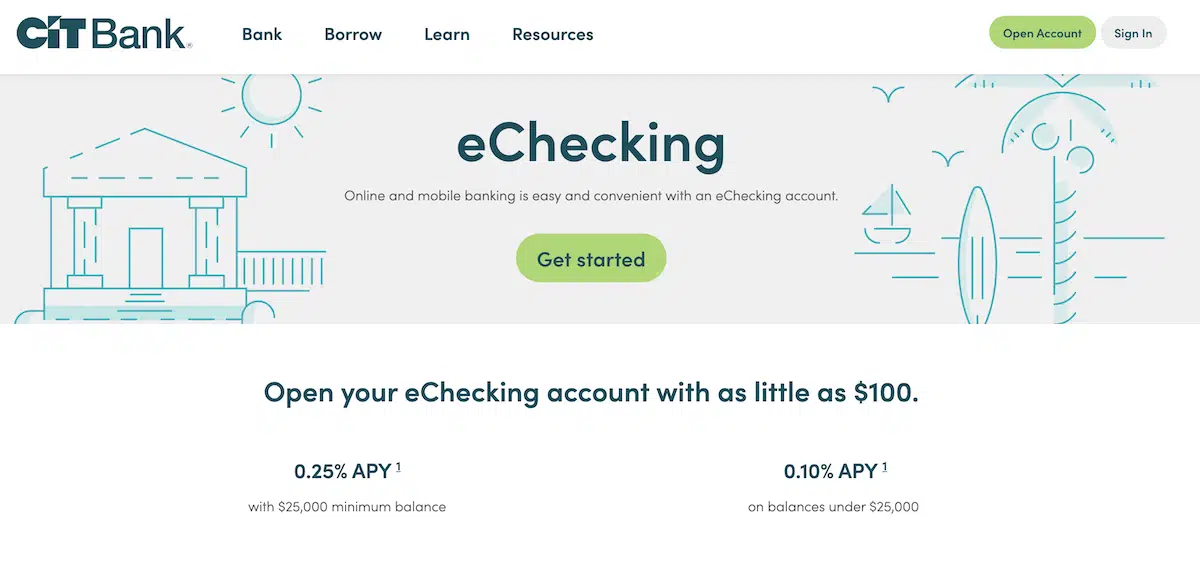

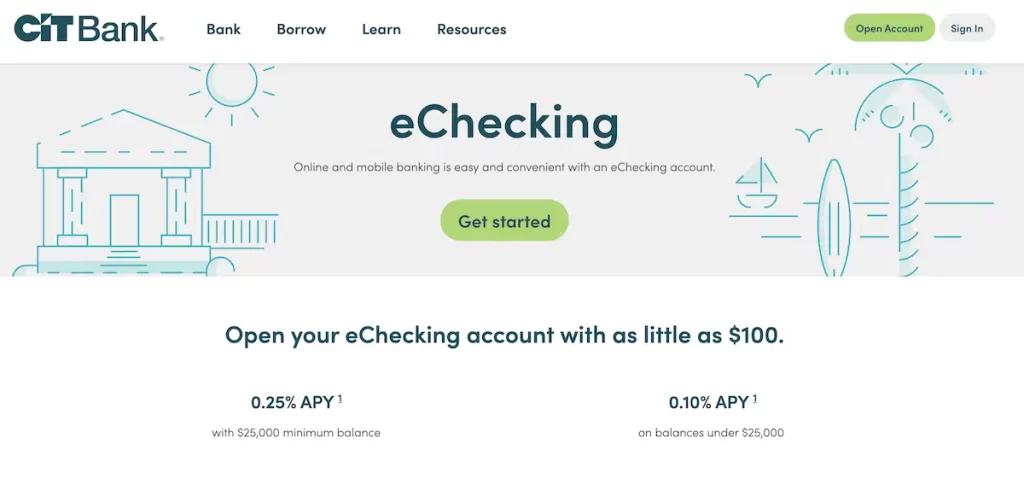

6. CIT eChecking

CIT eChecking provides the online checking account with plenty of features that you might not get if you are using a traditional bank account. With eChecking from CIT Bank, you will get various benefits, such as convenient online and mobile banking features with up to 0.25% APY for your account balance. You only need to deposit $100 to open an account with CIT eChecking.

Features:

- With CIT eChecking, you will get a debit card that uses the EMV chip technology, along with 24/7 access to the online and mobile banking system.

- You can deposit checks using CIT mobile banking app, and you can also make unlimited disbursements and withdrawal by using the CIT mobile app.

- CIT eChecking doesn’t charge any ATM fees, and you can use it with Apple Pay, Samsung Pay, Zelle, and Bill Pay.

The fact that CIT pays 0.10% APY on balances under $25,000 is a bonus. (The APY is slightly higher for larger balances.) Other online checking accounts pay more, but they often require a series of spending and deposit qualifications to earn the high rate. Another upside is that CIT offers $30 per month in reimbursements of outside ATM fees, and it doesn’t charge any ATM fees itself.

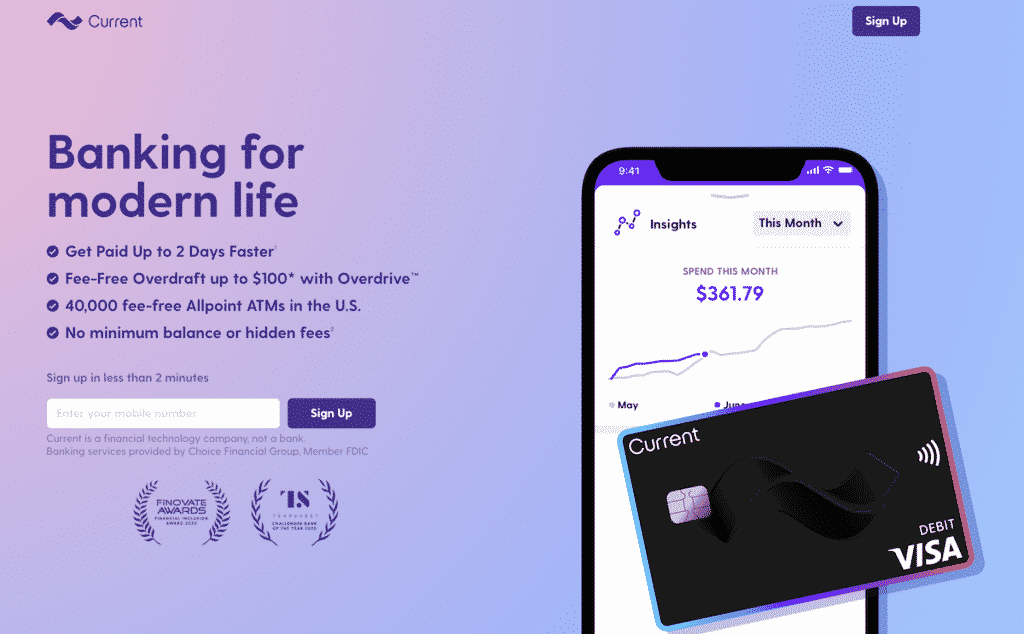

7. Current

Current is a financial technology company that offers better banking features than most traditional banks. It allows you to save and manage your money in your own way, and you can get your paycheck as early as 2 days before the pay day. There are plenty of features you can use with Current, which will give you better flexibility in handling your money.

Features:

- You can enroll to receive your paycheck 2 days early if you get paid via direct deposit.

- There are no hidden fees when you use Current banking services, and it also provides fee-free overdraft for you.

- Current also offers you various money management features, which allow you to manage your spending in a better way while keeping track of your cash flow.

Official URL: Current

8. Chime

Chime provides banking services suitable for freelancers and self-employed workers, with fee-free overdraft, no fees per month, and no minimum balance. With Chime, you can get a secured credit card you can use to increase your credit score by 30 points on average. You can also use Chime to pay anyone in an instant, and you don’t need to pay for the transaction fee when you send money to others.

Features:

- Chime has an automatic savings feature that allows you to earn 1.50% APY¹ for your account balance.

- You can get paid early via direct deposit, and you can also stay informed about your banking activities with transaction alerts and daily balance notifications.

- Chime provides the security features that include advanced security system, FDIC insurance for up to $250,000, privacy for your account, and 24/7 support.

- No monthly fees, no overdraft fees.

- 60,000-plus free ATMs.

- Paycheck arrives up to two days early with direct deposit (see below for more information from Chime).

- Get spotted $200 with Chime SpotMe

¹The Annual Percentage Yield (“APY”) for the Chime Savings Account is variable and may change at any time. The disclosed APY is effective as of August 25th, 2022. No minimum balance required. Must have $0.01 in savings to earn interest.

9. Oxygen

Oxygen provides a banking platform for entrepreneurs, freelancers, and creators, offering various rewards, benefits, and features for their personal and business accounts. With Oxygen, freelancers and self-employed people can enjoy various rewards, robust APY for their savings, quick payment, and more. With Oxygen, you will get a Visa debit card that offers 2% cash back rewards and various benefits for your retail transactions.

Features:

- Oxygen allows you to create savings goals and earn robust APY for the money you save in your account.

- You can earn cashback rewards from approved merchants and get paid 2 days early via direct deposit.

- You will also get virtual cards for digital transactions, and you can use Oxygen to send and receive money with other users.

Official URL: Oxygen

10. LendingClub Business Checking

LendingClub Business Checking provides the online and mobile banking system for businesses, organizations, and institutions. It comes with advanced security features, account management, easy payments & transfers, and best support from LendingClub staff. You can use your LendingClub Business Checking account to manage various business transactions and keep all your business transactions secure and private.

Features:

- With LendingClub Business Checking, you can use various business features, such as bill payment, wire transfer, stop payment placement, loan payment, and more.

- It also offers security features, such as account and security alerts, card control, and security token service.

- With this account, you can use Autobooks for accounting, reorder checks, and deposit your checks.

Official URL: LendingClub Business Checking

Other Traditional Banks to Consider

Aside from the earlier list of bank accounts for freelancers and self-employed workers, some traditional banking institutions also offer business accounts for their customers, allowing them to manage and run their business with ease. However, with these traditional banks, you often need to visit the nearest branch to open a business account with them. Here are the other traditional banks to consider for freelancers and self-employed workers:

11. NFCU Business Checking

NFCU (Navy Federal Credit Union) provides the business checking and savings accounts to help you operate your small business. The Business Checking account from NFCU is perfect for new businesses, and you don’t need to pay for any fees per month with this account. NFCU Business Checking also provides the GO BIZ debit card, which features tap to pay technology, Visa travel accident insurance, and zero liability policy for any unauthorized transactions.

Official URL: NFCU Business Checking

12. Capital One Spark Business Basic Checking

Capital One Spark Business Basic Checking provides businesses with the basic cash flow management that gives them unlimited digital transactions each month. You will need to pay a $15 per month service fee with this account, but you will also get some useful features, such as overdraft coverage, fee-free digital, free debit cards, online bill pay, and bank on the go. You can eliminate the basic $15 fee per month by maintaining a $2,000 minimum account balance.

Official URL: Capital One Spark Business Basic Checking

13. Wells Fargo’s Initiate Business Checking

Wells Fargo’s Initiate Business Checking provides business owners the reliable banking solutions to help run their business as best as possible. It provides features such as 24/7 fraud monitoring, tap to pay, account alerts, mobile deposits, customized cards and checks, zero liability protection, and many others. You will need to pay a $10 fee per month to maintain your account, but you can waive this fee by maintaining the $500 daily balance in your account.

Official URL: Wells Fargo’s Initiate Business Checking

14. Chase Business Complete Banking

Chase Business Complete Banking provides business owners with an easy way for them to manage their cash flow and save their time in doing banking activities. It provides various essential tools for small businesses to manage their business with unlimited ATM and debit card transactions. You will need to pay a $15 fee per month, or you can waive the fee by maintaining $2,000 daily balance in your account.

Official URL: Chase Business Complete Banking

15. Bank of America Business Advantage Checking Account

Bank of America Business Advantage Checking Account provides you with easy business management tools you can use, such as mobile check deposit, cash flow monitor, and so on. It also has the fraud protection and security features to ensure each transaction in your checking account is legit and authorized by you. You can choose the Business Advantage Relationship Banking account if you want more features, such as QuickBooks integrations, employee account access, and more.

Official URL: Bank of America Business Advantage Checking Account

Best Banks for Freelancers Summary

These are the banks for freelancers that you can use to help you run your freelancing business better. You can send invoices, deposit checks, send the payroll to your employees, and fill your tax information with these banks. You can also get other benefits, such as mobile banking, debit cards, rewards, and many others.

Best Bank Accounts for Entrepreneurs FAQs

It’s not a necessity, but it will depend on your needs. You can open a separate freelancing account if you want to separate between your business expenses and personal expenses.

You can set up a business checking account in an instant if you have met the requirements for setting the account. To set up a business account at a bank branch, you might need to wait for a few days before you can use your account.

You can use most banks listed in this guide, as many of them offer free transactions and no fees per month.

It will depend on the bank, but the interest will be offered to you as APY (Annual Percentage Yield), and you can earn the interest from the account balance you have.

Most banks for freelancers listed in this guide can help you operate your business. They offer various business-related tools to make it easier for you to run your freelancing business.

It’s best to avoid banks for freelancers that require you to reach a minimum balance just to waive the service fees per month. It’s also good for you to avoid banks for freelancers that require you to pay for service fees per month and go with the one that doesn’t charge any service fees per month.